the Subbie Tax App saves you money!

A quick and easy way to handle all your payslips, receipts, mileage and HMRC letters. The average Subbie Tax refund is between £2000 and £4000.

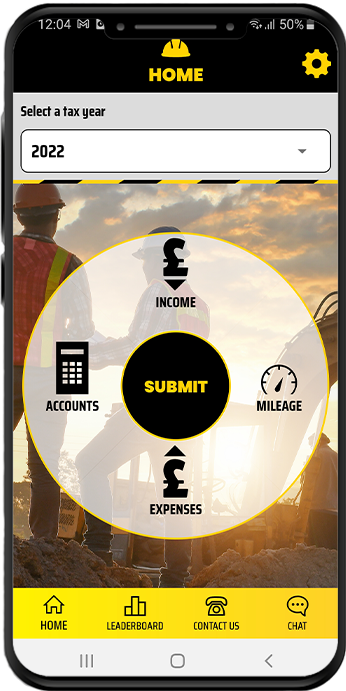

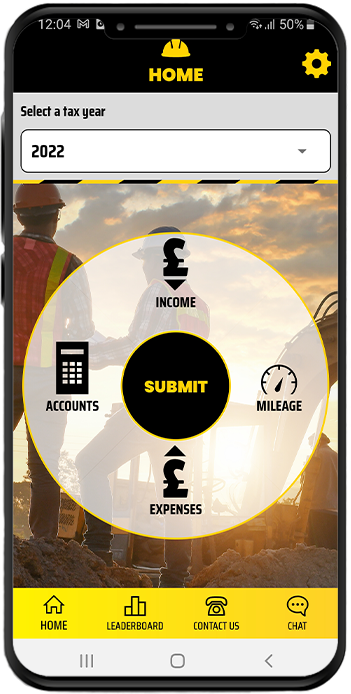

- Quick and easy to use

- Submit receipts, mileage and income

- Expert advice from qualified accountants

- Average Subbie Tax refund £2k - £4k

- Designed for Sub Contractors

- Personally assigned accountant

- Chat feature to speak to accountant anytime

- 1000+ Downloads

- 5 Stars Rating

What Subbie Tax can do for you

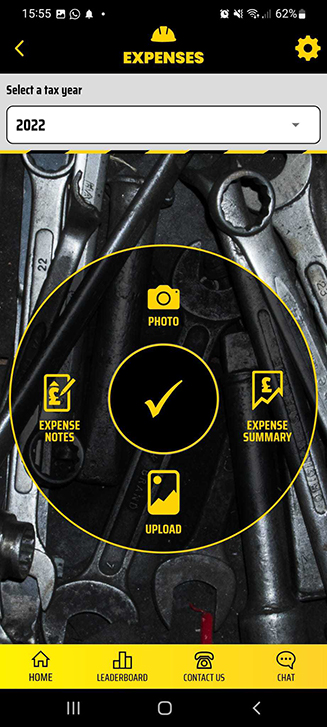

Expenses

Take photos of your receipts or complete your expenses with user-friendly expenses summary sheet.

Mileage

Fill in a record of a journey, add notes and submit. Log regular journeys to make it even easier to add frequent trips.

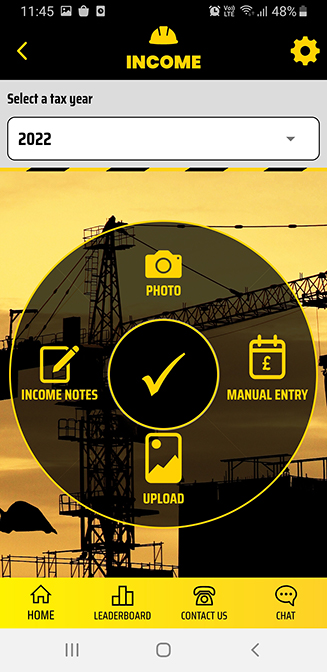

Income

Take and upload pictures, add notes or create as many manual entries as you need. They can be weekly, monthly or annually – it’s up to you.

Accounts

Take photos of letters from HMRC, or see letters we’ve received on your behalf, and be notified of anything you need to action.

Advantages of using Subbie Tax

- Only £199 with no upfront cost

- Avoid penalties for late submission

- Typical refund £2-£4k

- Assigned own personal accountant

- Subbie Tax discuss accounts before submission

- Personal, expert advice from qualified accountants

- Referral Leader Board

- Chat to one of our advisors through the app chat function

Happy Clients,

Great Reviews

Learn about Subbie Tax from other users and start streamlining your business today

Brilliant! Such an easy app to use! Love it! Fast response from the accounting team, everything I need in one app. Highly recommend to all Sub-contractors.

Marek Kowalkowski

I was assigned my own personal tax adviser, it was so quick and easy! The experience was completely personalised for me and there wasn’t even an upfront payment required. I would recommend to anybody!!

Matt Wilsons

Really simple app, great for my tax returns. Same sort of price as my accountant but easier to do it this way.

Phelix Plush

Blog

A Guide to Submitting Your Tax Return as a Self-Employed Sub Contractor

We know how taxing (pun intended) it can be to navigate the complex maze of the UK tax system, especially as a self-employed sub contractor.

Do I need to register for CIS if I am a subcontractor?

If you’re a subcontractor working in the construction industry in the UK, you’ve probably come across the term ‘CIS’. The Construction Industry Scheme (CIS) is

How Subcontractors Can Keep Their Finances Organised with Subbie Tax

Let’s face it as a subcontractor, managing your finances can be a complex and time-consuming task. From tracking expenses and income to managing your mileage,

What is the Construction Industry Scheme and what are the benefits?

The construction industry is a major contributor to the UK economy, and it encompasses a vast number of projects, from commercial to residential developments. The

Maximizing Your Construction CIS Tax Refunds with Subbie Tax

When it comes to tax refunds in the construction industry, many self-employed workers and subcontractors are often unaware of the substantial reimbursements they may be

Registering for Self Assessment and Filing Your Tax Return

Self-assessment tax returns are a crucial part of the UK’s tax system and are required annually for anyone who is self-employed, as well as for